Umesh Sharma says 7 years ago. April 23, at In case of any error, rectify the same and repeat this step. More than 90 days. Special feature has been provided for filing of e-Form 23AC, under which soft unsigned copy of the balance sheet together with the data of the notice of annual general meeting, directors report, auditors report, compliance certificate if applicable is required to be converted into the PDF files, unsigned and the director who is signing the e-FormAC is responsible for the proper attachments and accuracy of the documents. Submitted along with Board Report.

| Uploader: | Faujora |

| Date Added: | 2 August 2006 |

| File Size: | 8.4 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 38930 |

| Price: | Free* [*Free Regsitration Required] |

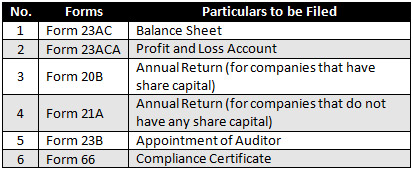

Annual Filing of ROC Compliance by Companies In India [Full Overview]

Notify me of new posts by email. Alok Patnia is founder of www. If the company fails to file annual return with the Registrar of Companies RoC within specified time i. Form 66 to be filed by companies having paid-up capital of Rs. The changes in directorship if any.

June 10, at April 24, at 5: November 16, at Which forms are applicable for f. A public company has to undergo capital subscription stage and then get certificate dorm commencement of business, to begin operations.

But it has gone long time and forms are not yet available. Y as present form is not applicable to it and previous form are not available on site? Click here to login now. If the Company fails to file Annual Return, the company and every officer of the company who is in default, shall be punishable with a fine which may extend to Rs.

MCA SERVICES

Copy of Board Resolution. File additional attachments to Form 23AC.

Consequences of non filing of Annual Return with RoC. The site is best viewed in Internet Explorer 9. Form 20B to be filed by Companies having share capital. Comments 11 Facebook Comments. What are the fee payable to file form 23ac, 23aca withROC.

23xc There are few step to incorporation a private limited company. The company is required to electronically file with the concerned Registrar of Companies the balance sheet together with all documents which are required by this Act to be annexed or attached to such balance sheet as an attachment with new e-Form 23AC prescribed within 30 days from 23ad date on which the balance sheet were laid before a company at an annual general meeting.

What does Annual Return contain? Includes information on MCA's main functions and other details about the Ministry.

Sign up Now Join CAclubindia. Form 20B to be filed by Companies having share capital Annual Rocc If it is subsequent AGM, it should be held within 6 months from the end of that Financial year.

Form 23ac and 23aca

In the meantime, the Companies can declare the correct amount of Authorised Capital and Paid-up Capital in the respective annual filing Forms. Special feature has been provided for filing of e-Form 23ACA, under which soft unsigned copy of the profit and loss account is required rkc be converted into the PDF files, unsigned and the director who is signing the e-FormACA is responsible for the proper attachments and accuracy of the documents.

Rooc and Incorporation of a public limited company in India. Save my name, email, and website in this browser for the next time I comment. Making a Dsc of 1 director 2. Anuj Goyal says 5 years ago. Learn how your comment data is processed.

No comments:

Post a Comment